By FocusEconomics Insights

ASIA – The Chinese economy is currently grappling with numerous regulatory reforms, a bloated, debt-ridden property market, and a zero-tolerance approach to the pandemic, which continues to limit economic growth both domestically and in the region. As a result, over the past couple of months Chinese authorities have taken several measures to stimulate the economy, including a 50 basis-point cut to the reserve requirement ratio and a 15 basis-point cut to the one-year Loan Prime Rate. This comes as major central banks in developed markets look to roll back their stimulus measures to counter price pressures.

The divergence in policy decision-making between China and the West stands in sharp contrast to the coordinated efforts made at the start of the pandemic and raises concerns for global economic prospects in 2022. Indeed, last week, President Xi Jinping warned major central banks that siphoning monetary stimulus too early would have serious economic consequences across developing markets. That being said, it should be viable for China’s monetary authorities to go against the grain, as domestic consumer inflation is relatively in check, capital inflows remain healthy and growth prospects will be supported by ongoing stimulus efforts.

The divergence in policy decision-making between China and the West stands in sharp contrast to the coordinated efforts made at the start of the pandemic and raises concerns for global economic prospects in 2022. Indeed, last week, President Xi Jinping warned major central banks that siphoning monetary stimulus too early would have serious economic consequences across developing markets. That being said, it should be viable for China’s monetary authorities to go against the grain, as domestic consumer inflation is relatively in check, capital inflows remain healthy and growth prospects will be supported by ongoing stimulus efforts.

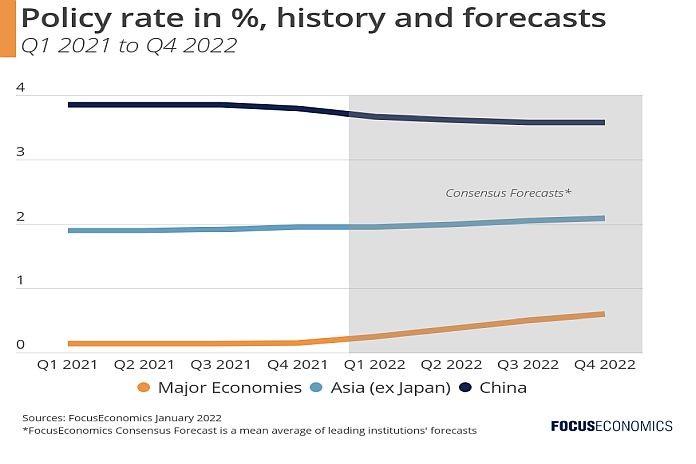

Our latest FocusEconomics Consensus Forecast sees GDP-weighted average policy rates in major economies rising from 0.14 percent at the end of 2021 to 0.48 percent by the end of this year, with these figures likely to be revised upwards in our upcoming report. Our panel also estimates GDP-weighted policy rates in Asia (excluding Japan) to reach 2.09 percent by the end of 2022, which is higher than the 1.90 percent logged at the end of last year. In contrast, China’s interest rates are seen dropping further as the Central Bank continues to prop up the economy.

Our complete China coverage is available exclusively for newsletter subscribers in this free report.

Insights from Our Analyst Network

Commenting on the monetary policy outlook for China, analysts at ING noted:

“The impact of the zero-Covid policy and regulatory blast that has hit sectors from energy to education, and most notably property development in recent months, is weighing on growth to the extent that the People’s Bank of China has been cutting rates since mid-December, and cut again in January. We anticipate more rate cuts over the coming weeks and possible months as well as additional reductions of the Reserve Rate Requirement.”

Furthermore, commenting on the monetary policy outlook for the US, James Orlando, a senior economist at TD Economics, noted:

“The Fed is all but guaranteed to hike its policy rate in March. From there we have the Fed hiking every three months until the policy rate gets to 2 percent. Clear communication to this end will help lift bond yields and slow demand, easing some of the supply/demand imbalances that are responsible for the high inflation environment that we have now.”

Our latest analysis

Euro area business activity growth slows in January amid the spread of Omicron variant. Economist Massimo Bassetti takes a closer look.

Germay’s economy recovered at moderate pace in 2021. Read economist Jan Lammerson’s analysis.

The return of the left, fiscal troubles and political polarization: In our latest special report, our economist Oliver Reynolds examines the key political events on the horizon in the Americas in 2022, their likely outcomes and the economic implications.