By Deniz Anginer and Ata Can Bertay

It has been more than ten years since the failure of Lehman Brothers in September 2008. The Global Financial Crisis (GFC), which followed, was one of the most damaging since the great depression. To avoid the collapse of the global financial system, governments worldwide have made unprecedented interventions in the markets to rescue large financial institutions using public resources.

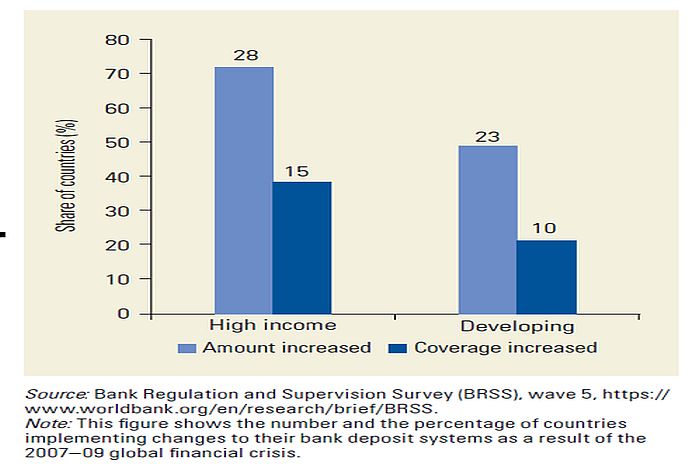

There has been a significant expansion of deposit insurance in both coverage and scope (Figure 1). Several countries, including Australia and Singapore, introduced explicit deposit insurance schemes for the first time. Other countries, like the US and Spain, substantially increased the coverage limit, while others introduced unlimited coverage in order to restore confidence in the markets. Most notably, Ireland introduced a blanket guarantee to cover bank bonds, subordinated debt, and interbank deposits. The increased coverage amounted to about 200 percent of Ireland’s GDP.

During the global financial crisis, the so-called implicit guarantees also became explicit as taxpayer funds were used to nationalize and to recapitalize banks and to provide guarantees on bank liabilities. The cost of these interventions has been high with the taxpayers bearing most of the brunt. During the banking crises after 2006, the average peak liquidity support reached 15 percent of deposits and the average bank recapitalization costs were seven percent of GDP.

Figure 1: Deposit insurance coverage in response to the GFC

In the second Chapter of the GFDR, we discuss these interventions and examine their impact on market discipline. Market discipline refers to the process by which market participants, such as depositors and shareholders, monitor the risks of banks, and take action to limit excessive risk-taking. Drawing on the literature, we argue that for market discipline to work effectively, market participants must have the information, the means, and, most importantly, the incentives to monitor and influence banks. In other words, market participants must-have “skin in the game”.

This requires banks that have taken excessive risk to fail and for bank investors and depositors to share the losses when they do. Government interventions in the private market to bail-out large financial institutions have significantly reduced the long-term incentives to monitor and discipline these banks.

In the aftermath of the crisis, following policy goals set by the FSB, a number of countries have introduced legislation and regulatory reforms to address the risk posed by systemically important institutions and to strengthen market discipline. In particular, there were reforms concerning capital and liquidity regulations -increasing capital and liquidity requirements overall, and additional surcharges were instituted for banks deemed systemically important. The focus has also been shifting from supervision to resolution.

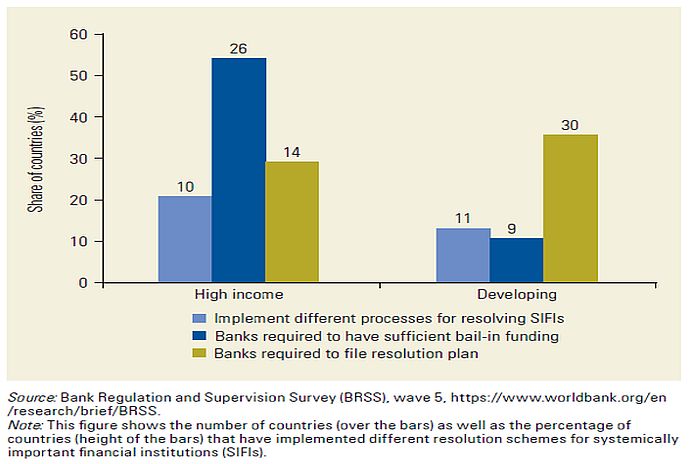

There are new resolution processes for systemically important banks and new requirements for these institutions to hold the so-called bail-in debt to aid in the resolution process (Figure 2). New macroprudential rules have also been introduced to enhance risk management and risk reporting processes at banks, including periodic stress tests, to determine whether banks have sufficient capital to absorb losses.

Figure 2 Requirements implemented for resolving SIFIs

Although many countries adopted these reforms, some key policy issues remain. In particular, how cross-border resolution will be implemented, and how bail-in funds will be shared between the host and home country supervisors remain unclear. It is also not clear whether bail-in funds will be sufficient to recapitalize bridge banks during the resolution process so that taxpayer funds are not at risk.

Finally, the impact of bailouts and blanket guarantees, we discuss in detail in the second chapter of the GFDR, will have long-term effects on incentives going forward.

![]()