By Min Kim

Central bankers in emerging market and developing economies (EMDEs) have been seeking policy tools other than the traditional interest rate policy. The reason is that these economies are vulnerable to financial disruptions due to sharp reversals in capital inflows, known as sudden stops, where foreign investors suddenly withdraw their funds. Yet the use of so-called unconventional monetary policies has not been fully supported from a theoretical perspective. The recent literature, including the IMF’s work on the Integrated Policy Framework, has started to provide frameworks to explore these tools.

Related to this literature, in my job market paper, I propose a theoretical framework for sterilized asset purchase programs. Asset purchase programs are unconventional monetary policies that EMDEs conducted for the first time during the recent COVID-19 crisis (IMF 2020; World Bank 2021). The details of the programs vary across countries. Figure 1 shows the amount of asset purchases by 14 EMDEs from March to August in 2020. An interesting observation is that in many cases, asset purchases were sterilized to avoid inflationary pressures. This feature contrasts the policy with quantitative easing in advanced economies. Instead of creating the monetary base (for example, bank reserves), central banks used various means to sterilize asset purchases. For instance, Poland issued central bank securities, while Croatia sold foreign exchange (FX) reserves (Arena et al. 2021).

Based on this observation, I address two questions in the paper: (i) Can a sterilized asset purchase program be an effective policy tool in sudden stops? (ii) How to design this new tool, which asset to purchase, and how to sterilize?

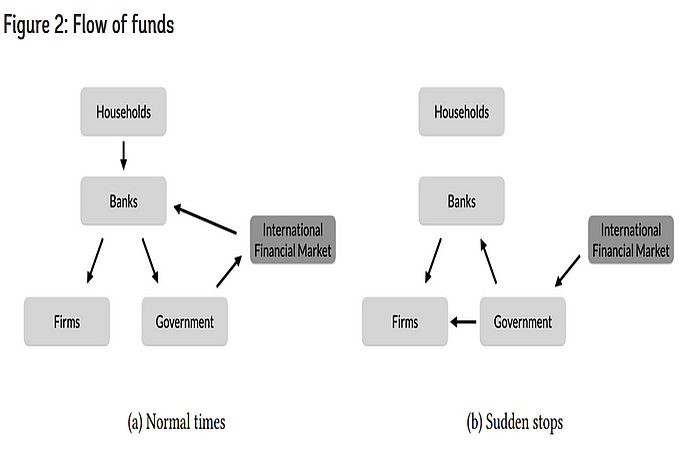

I build a small open economy model to examine the effectiveness and design of sterilized asset purchase programs. The model economy is inhabited by households, banks, nonfinancial firms, and the consolidated government. To reflect the stylized facts about EMDEs, I impose (i) liability dollarization, (ii) financial market imperfection, and (iii) fear of losing reserves. Specifically, banks borrow in foreign currency from households and foreign investors. Banks then lend to nonfinancial firms in domestic currency. Banks also operate under the leverage constraint, which becomes binding in sudden stops. The government purchases corporate bonds and sterilizes these purchases by selling FX reserves. But the use of reserves is limited due to the fear-of-losing-reserves constraint.

Figure 2 describes the flow of funds in the model economy. In normal times, banks are at the center of funding flows, intermediating the supply of funds (from households and foreign investors) and the demand for funds (by nonfinancial firms and the government). The government, in turn, accumulates FX reserves in the international financial market. In sudden stops, however, the government plays a key role in funding intermediation. The government conducts sterilized asset purchase programs to ease financial market disruptions. Doing so provides liquidity to the firms and relaxes the banks’ leverage constraints.

Policy implications

My paper provides valuable policy implications for EMDEs. Conducting sterilized asset purchase programs mitigates the impact of sudden stops, improving welfare. The policy becomes most effective when corporate bonds are purchased with sterilization using FX reserves. It is crucial to acknowledge policy trade-offs. Large-scale asset purchases may also slow down the recovery. Finally, hoarding FX reserves helps improve policy room to combat sudden stops.