By Ray Chickrie

PARAMARIBO, Suriname — After a major oil discovery two weeks ago off the coast of Suriname, president Desi Bouterse said, “We have to keep a cool head. Put all negativity aside and jointly see how we can seize this moment for the development of Suriname.” He is correct, it’s a “momentous” trajectory in the history of Suriname.

Suriname has laid the foundation for a robust and fair oil deal with Apache and Total Oil, put in place decades ago when State oil company, Staatsolie was founded in 1980.

“Staatsolie is happy … but this is more of national success,” says Staatsolie director Rudolf Elias to Starnieuws in an initial response to the oil discovery off the Surinamese coast. “Let’s handle it well,” he added.

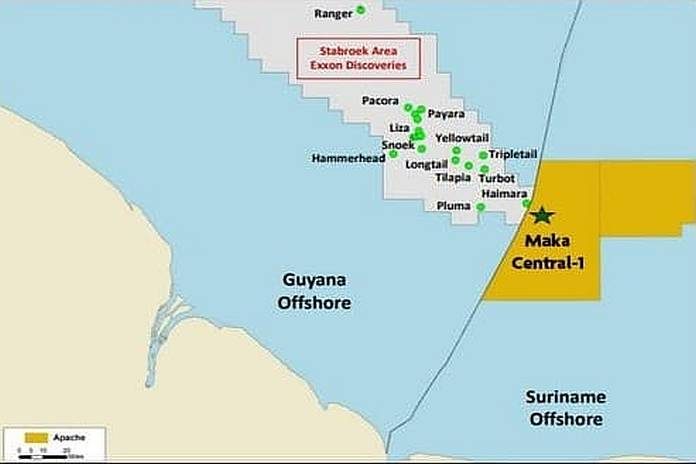

On January 7, Apache Corporation, which signed a Petroleum Sharing Contract (PSC) with Staatsolie in July 2015, released a statement that they found “high quality and significant” oil and gas off the coast of Suriname in block 58 which is adjacent to Stabroek Block, the gigantic Exxon-Mobil oil fields of neighbouring Guyana.

The company said “Preliminary formation evaluation data indicates the potential for prolific oil wells,” said Apache chief executive John Christmann. “Additionally, the size of the stratigraphic feature, as defined by 3-D seismic imaging, suggests a substantial resource.” It’s now reported that the county may have found an estimated 300,000 barrels of oil.

Suriname which established an oil and gas industry in 1980, five years after independence is better positioned to profit considerably than its neighbour Guyana. With the creation of Staatsolie, Suriname is better to negotiate a fair deal in any oil and gas discoveries. Suriname said its a “historic moment” for the country.

The Guyana Exxon-Mobil oil Production Sharing Contract (PSC) has come under widespread local and international criticism as being “another form of economic colonialism” of Guyana.

Guyana is said to be getting two percent royalty. Suriname on the other hand is expected to earn 6.25 percent in royalties. It is alleged that Guyana does not have capacity and legislation to stand up to the US giant. The signing bonus of 18 million was condemned as peanuts. Suriname, on the other hand, collected US $100 million signing bonus. But there are other components of the agreement that exploits Guyana experts have identified.

A petroleum agreement and prospecting license with Exxon-Mobil for approximately 600 blocks were signed by the former US-born Guyanese president, Janet Rosenburg Jagan on June 14, 1999. The largest bloc in the history of Guyana was awarded critics say. According to Christopher Ram, public accountant, “this contravenes the governing petroleum laws which only allow a maximum of 60 blocks.”

However, former president of Guyana and the successor of Jagan, Bharrat Jagdeo in the party newspaper, The Guyana Times, claimed that “the law does provide for ‘special circumstances.”

“Jagdeo opined that the move was, in fact, significant from a geopolitical perspective given the renewed Venezuela claims. It demonstrates that the United States of America recognises the territory as sovereign to Guyana.”

Elias said.”I am especially happy for my children and their children. They are looking forward to a bright future.” Elias is confident that just like neighbouring Guyana, Suriname will make more oil finds. And under his leadership, Staatsolie in 2019 made a profit of USD 185 million”.

Suriname is far ahead. It has a PSC( https://www.staatsolie.com/media/tuvjyme3/model-psc.pdf) that gives it a partnership with any investors. It has been in the oil business for some time and has all the legislation in place to protect itself from exploitation. It has capacity. They have been refining oil for some time. The oil revenue isn’t controlled by the government but a board of individuals of all races at Staatsolie whose books are transparent. Staatsolie has diversified its portfolio. The company also invests in gold mining.

The corporate social responsibility (CSR) is included in all PSCs. “In the Production Sharing Contracts (PSCs) our partnering international oil companies (IOCs) have agreed to allocate a certain amount per year for community development and/or training programs within the petroleum industry. The corporate social responsibility (CSR) must stimulate the development and welfare of our communities. Focus is among others on the environment, health, education and capacity building.”

“The State has the option to participate in the operations” if it wishes to execute this right. According to Article 32 of the Mining Decree (Official Gazette 1986 no. 28), the minister in charge of mining affairs has to inform the applicant within two months after having received an application for mining rights. This right is normally assigned to a State Enterprise (Staatsolie), Elias said.

“In the final investment decision, Suriname / Staatsolie must also state whether it will participate with the 20 percent. And then we also have to put the money on the table,” Elias noted. “That amount will certainly be between 800 million and US $ 1.3 billion. An oil drilling platform costs between US$ 4 to US$ 6 billion. First, there is a study, then appraisal wells are drilled and then a whole design has to be made about how the oil will be extracted from the soil. Building a refinery takes at least 3 years. “The first oil that you get from the ground takes at least 4.5 to 5 years minimum. Only then will we start earning money,” he told Suriname Star News.

With this sort of partnership, capacity, and legislations in place, Suriname stands strong and is less vulnerable to exploitation from giant oil companies.

Some features of the Suriname Production Sharing Contract (PSC)

Royalty

Pursuant to Article 65 of the Mining Decree (Official Gazette 1986 no. 59), the concessionary is required to pay royalties to the government. The royalty rate differs for different onshore contract onshore and is established by State Decree. Current royalty rates are between 3 percent – 12½ percent.

On January 16, the Guyana Kaieteur News claimed that “Staatsolie, Suriname’s state oil company, has disclosed that contractual provisions allow it to participate as an investor up to a maximum of 20 percent in the development of a well; while noting that the State earns 6.25 percent in royalties. This is more than three times what Guyana was able to negotiate for its globally praised light sweet crude in the Stabroek Block.”

The newspaper added that Apache and Total “will pay 36 percent tax on income to the Surinamese administration. In the case of Guyana, ExxonMobil, Hess Corporation and CNOOC/NEXEN can breathe easy as the coalition government has generously opted to pay the taxes of the companies out of its share of profit oil.”

Environment/operating regulations

All measures must be taken to prevent hydrocarbon spills and damage to the deposits, and to reduce damage to agricultural and fishing activities, river beds and water sources, the coast, sea and sea beds (Chapter III of the State Decree Regarding Mining Installations, Official Gazette 1989 no. 38). Furthermore, all hydrocarbon activities must be developed so as to prevent damage to the environment.

Regulatory Body

The accountants and representatives of the State Enterprise shall at all times have access to the facilities, equipment, activities, accounts, files and registers of the Contractor with respect to a petroleum agreement concluded with it, as well as the right to inspect, supervise and investigate. (Article 14 of the Petroleum Law, Official Gazette 1991 no. 7).

Domestic Supply

If petroleum available to the State is not sufficient for local consumption, the concessionary and contractors are required to supply the State with the necessary petroleum. Petroleum for domestic supply shall be valued at market price. General legal rules applying to the petroleum industry: Surinamese tax system is based on the Income Tax Law of 1922 (Official Gazette 1995 no. 114). All companies and individuals domiciled in Suriname are subject to taxes on profits, property, sales and services.