By FocusEconomics Insights

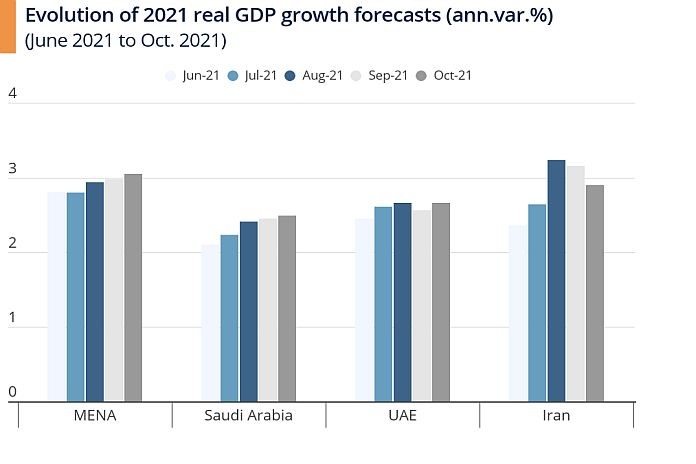

TAIWAN / ASIA – The analysts we polled have grown more upbeat about the outlook for the economy of the Middle East and North Africa (MENA) in recent months, with the consensus 2021 GDP growth forecast for the region being revised up 0.3 percentage points since June.

This is likely in part the result of OPEC+ gradually loosening its grip over global oil supply: the cartel agreed to raise production limits by 0.4 million barrels per day (mbpd) from August. Moreover, surging global oil prices bode well for the public coffers of regional oil exporters, which should support government spending. In addition, several key economies, such as Israel, Saudi Arabia and the UAE, have had successful vaccine rollouts -Israel and the UAE in particular are world leaders when it comes to the pace of vaccination- which has aided domestic activity.

That said, growth prospects remain poor relative to other world regions. Despite concerted efforts from many governments to spur economic diversification – with Saudi Arabia’s Vision 2030 scheme being a notable example – MENA is still heavily reliant on oil, with the exception of a few isolated areas such as Dubai, which have managed to branch out into other sectors such as tourism and financial services. In Saudi Arabia for instance, the oil sector still accounts for roughly 40% of GDP. Moreover, in the case of Iran, economic activity is likely to continue to be held back by tensions with the West.

Insights from our analyst network

Regarding OPEC output, Khatija Haque, head of research at Emirates NBD, said:

“While we believe the market can absorb an extra 400k b/d of oil every month through the end of this year, if this pace of increased output is maintained through 2022, all of the pandemic related cuts would be unwound by the end of Q3. It would also mean double digit growth in crude oil production for the major GCC oil exporters and thus sharply higher headline GDP growth in 2022. However, the oil market balance would return to surplus by H2 2022 in this scenario, based on current demand projections, putting downward pressure on oil prices. The question then is whether OPEC+ will continue to increase production at the current rate if it means accepting a lower oil price.”

On the outlook for Saudi Arabia’s oil sector, analysts at the EIU commented:

“Oil GDP began to recover in the second quarter as Saudi Arabia started to reverse its earlier cutbacks, and is set to rebound further over the remainder of 2021, helped by a further tapering of oil-output curbs. Under the latest OPEC+ agreement, the kingdom’s oil-production baseline is set to increase from 11m b/d to 11.5m b/d in May 2022. Although we expect actual production to remain below this level in 2022, averaging just under 10m b/d, this will still represent a year-on-year rise of more than 8%.”

Source: FocusEconomics