By BDC

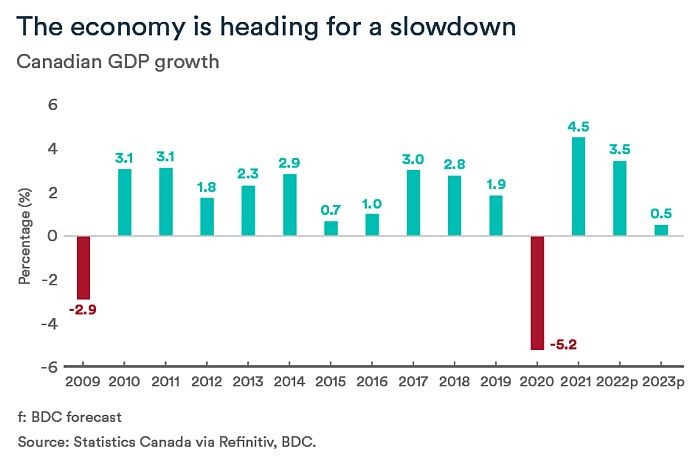

MONTREAL, Canada – The economic outlook has darkened rapidly in the second half of the year. Soaring inflation and interest rate hikes by central banks around the world to address it are of growing concern to households, businesses and economists. In Canada, some financial institutions have already sounded the alarm about a looming recession.

Regardless of how you describe what’s coming, one thing is certain—the Canadian economy is set to slow down as we head toward 2023. What will the impacts be on the economy? This month’s economic letter looks at the industries most likely to struggle.

What’s causing the slowdown?

Unsurprisingly, the cause of the economic slowdown is the tightening of credit conditions. After more than a decade of low interest rates, households, businesses and governments are now faced with much higher financing costs, putting severe pressure on budgets already taxed by rising inflation.

Of course, this is not the first time the Canadian economy has faced a period of monetary policy tightening. So, the impacts are easier to see coming than when the decline in economic activity comes from an unexpected shock, such as the COVID pandemic.

The companies that are most likely to struggle in 2023 are those that depend on discretionary spending, debt-financed consumption or close ties to the U.S. economy.

Erosion of purchasing power

The consumer discretionary sector encompasses an assortment of unrelated sub-sectors that share a dependence on consumer confidence. The fortunes of these businesses fluctuate with the economy because consumers can put off making these purchases. They include consumer durables such as appliances, apparel and consumer services, including hotels, restaurants and retailers.

This sector is vulnerable because rising interest rates and inflation are eroding consumers’ purchasing power, causing them to allocate more of their budgets to basic expenses such as food, housing and transportation categories that are experiencing the most significant price increases. While today’s tight labour market is leading to significant wage increases, they’re not enough to keep up with the rising cost of living.

Adding to the downside risk is that many of these sectors are still benefitting from pent-up demand from the pandemic. The current craze for travel and going out on the town is expected to moderate as the impact of rate hikes continues to percolate through the economy, but the downturn is likely to be less abrupt and somewhat delay, were it not for the lockdowns of the past two years.

Canadians turn cautious on borrowing to spend

When financing costs rise, the first sectors to feel the effects are those involving large purchases that are typically financed by debt. The real estate and construction industries top the list.

Since the Bank of Canada’s first rate hike in March 2022, residential property sales have fallen by 36 percent nationally and the average price is down 17 percent. The slowdown is expected to continue in the coming months.

Mortgage rates have experienced the largest increase in 30 years, which not only dampens demand for new mortgages, but also boosts payments for those who have taken variable rate mortgages or are up for renewal.

A national housing shortage and the scarcity of labour in the construction industry are mitigating the slowdown in housing starts that should have already begun. Starts jumped 11 percent in September compared to August. Nearly 300,000 units were started during the month on an annualized basis, the highest level in nearly a year.

Vehicle purchases also tend to decline rapidly during an economic downturn. However, once again, the post-pandemic environment is tempering the trend as consumers looking for a vehicle over the past two years have been faced with long lead times and limited selection.

Global slowdown—manufacturers on the front lines

Historically, manufacturing tends to be hardest hit in times of economic hardship, particularly if the downturn is global. Despite the proliferation of free trade agreements in recent years, 75 percent of Canadian exports still go to the US of which 65 percent are manufactured products. This makes manufacturers even more vulnerable to the economic turbulence that is currently occuring.

The slowdown is being felt around the world and this will be reflected in economies on both sides of the Canada-U.S border. Energy problems in Europe and the real estate debt crisis in China are further clouding an already declining global growth outlook due to tighter financial conditions.

Demand is declining for durable goods and building materials. As a result, the metals and minerals, lumber, machinery, and furniture manufacturing industries will be most affected by the slowdown, while manufacturers of agri-food, pharmaceuticals, and transportation equipment should continue to enjoy good demand. The strength of the U.S. dollar could also marginally temper the slowdown in exports and thus in manufacturing.

The bottom line is that as interest rates rise, the Canadian economy will slow down. The downturn will not hit all industries at the same time or with the same force, but all businesses should be ready for what lies ahead. Register to our webinar to learn how to prepare your business for the economic downturn.