Communique of the 96th meeting of the ECCB Monetary Council

BASSETERRE, St Kitts – The ninety-sixth meeting of the Monetary Council of the Eastern Caribbean Central Bank (ECCB) was held on July 24, 2020, via videoconference, under the chairmanship of Dr Timothy Harris, prime minister and minister for finance, Saint Kitts and Nevis.

Monetary stability

The Monetary Council received the governor’s report on monetary and credit conditions in the Eastern Caribbean Currency Union (ECCU) for the period January to June 2020.

The Council was apprised of the following:

- In 2020, global economic activity is expected to contract by at least 4.9 percent as the world deals with the effects of the COVID-19 pandemic. Growth in Advanced Economies is projected at negative 8.0 percent in 2020, compared with 1.7 percent in 2019.

- The ECCU economy has been severely disrupted and will contract between 10.0 and 20.0 per cent in 2020 before starting to recover in 2021. Key risks to the anticipated recovery include a delay in the global rebound; permanent job losses and business closures; natural disasters; and increasing credit and liquidity risks in the financial sector.

- Monetary and credit conditions in the ECCU deteriorated in the first half of 2020. That is, both the level of money available and credit extended decreased. This trend is projected to persist for the remainder of the year.

- Strong foreign exchange buffers, as a consequence of the ECCB’s prudent management of foreign reserves, coupled with financial stability will support gradual improvement in economic, monetary and credit conditions.

Having received the governor’s report and recommendations, the Council decided to:

- maintain the Central Bank’s Discount Rate at 2.0 per cent; and

- maintain the Minimum Savings Rate at 2.0 per cent.

Financial sector stability

The Monetary Council received the financial stability report for the ECCU for the period January to June 2020. The key highlights of the report were:

- The COVID-19 pandemic continues to place significant pressure on the economies of the ECCB member countries. However, the ECCU banking sector remained stable.

- The reduction in the ECCB’s discount rate will ease borrowing conditions for commercial banks and help to support liquidity if needed.

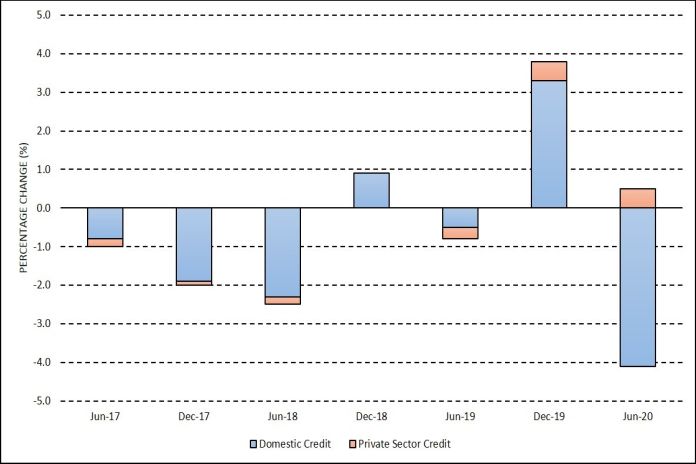

- Commercial banks and credit unions are likely to experience a significant increase in default risk, market risk and liquidity risk. Figure 1below shows percentage change in Domestic and Private Sector credit conditions in the ECCU from 2017 – 2020.

Figure 1: ECCU Domestic and Private Sector Credit – 2017-2020

Framework for macro-prudential regulation

The Council was apprised of the ECCB’s work on articulating an optimal framework for the ECCU financial system given the urgent need for comprehensive and coordinated oversight, especially of systemically important financial institutions, and adequate consumer protection.

Fiscal and debt sustainability

The Council was apprised that total public sector debt of the region is expected to rise in both nominal terms and as a percentage of GDP during 2020. Convergence to the Debt- to-GDP target of 60.0 per cent by 2030 will require substantial acceleration of growth and/or the generation of sustainable primary surpluses in the medium to long term.

The Council lamented the reversal of the significant progress made by member countries to meet the Debt-to-GDP target of 60.0 per cent by 2030. At the end of 2019, the Debt-to-GDP ratio stood at 65.0 percent.

The Council recognised that member governments will need to contract additional debt to fund critical support for their economies during this difficult period. The combination of economic contraction and the necessity of additional borrowing means a rise in the Debt to GDP Ratio in the short term.

The Council renewed calls for more financial support from the international community, at this time when the ECCU’s dominant sector, Tourism, is largely shut.

Growth and competitiveness

The Council was advised that:

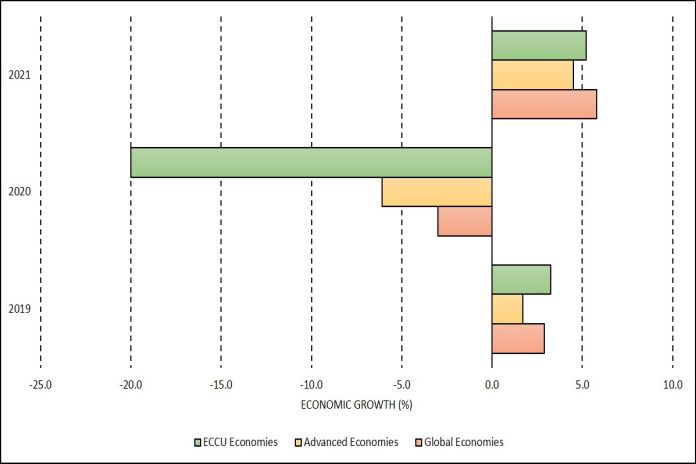

- The outlook for the ECCU in 2020 had changed profoundly due to the COVID-19 pandemic. Real GDP for the ECCU is projected to decline within a range of 10.0 percent to 20.0 percent this year, a stark contrast to pre-COVID anticipated growth of 3.3 percent. Figure 2below shows economic growth (percentage) in global, advanced and ECCU economies for 2019 – 2021. Figure 2 below shows economic growth (percentage) in global, advanced and ECCU economies for 2019 – 2021.

Figure 2: Economic Growth for Global, Advanced and ECCU Economies 2019-2021

- The economic decline is largely due to the decline in Tourism. The recovery of this dominant sector is expected to be protracted with performance unlikely to revert to pre-pandemic levels before 2023.

- The pandemic has resulted in a drastic reduction in jobs and incomes, lower government revenues and elevated unemployment.

Programme of action for recovery and resilience

The Council agreed that the COVID-19 pandemic offers an opportunity to unite around a programme of action for making the region’s economies more competitive, productive and resilient.

The programme of action will include the following:

- Enactment of modern insolvency and bankruptcy legislation to support the efficacious restructuring of businesses to protect jobs and to preserve financial stability;

- Determination of the optimal regulatory framework for the financial system of the ECCU and the enactment of a financial stability framework;

- Fast-tracking of the Caribbean Digital Transformation Programme;

- Launch of the EC Digital Currency (Cash) Pilot with an early expansion to all eight member countries;

- Enactment of modern payment system and services legislation; and

- Enactment of all outstanding legislation already approved by the Monetary Council including the credit reporting bill.

Enhanced coordination for collective action

In the context of the significant challenges facing the ECCU, the Council agreed to convene more frequently to address matters of critical importance and to work even more closely with the OECS Commission.

The areas to be addressed at the upcoming special meetings would include:

- Tourism

- Labour Markets

- Digital Transformation

- Business Support;

- Citizen by Investment Programmes (CIP)

Report from the Technical Core Committee on Insurance (BAICO and CLICO)

BAICO

The Council approved a funding proposal of US$1.4 million to support the payment of outstanding claims to 250 policyholders under Policyholder Assistance Scheme (PAS), which was established in 2013 when SAGICOR purchased the portfolio. The PAS was established to help settle surrenders, maturities, claims and bonus payments owed to policyholders at the time of sale.

CLICO

The Council was updated on the steps being taken to pursue and protect the interest of ECCU policyholders by pursuing an application, under Section 60 of the Barbados Insurance Act, for the winding up of CLICO International Life Insurance Co. Ltd.

Date and venue of 97th meeting of the Monetary Council

The Council agreed that the 97th meeting of the Monetary Council will convene on Friday, October 23, 2020 at 9:00 a.m. via videoconference.

Council Members attending the meeting were:

- Dr Timothy Harris, prime minister and minister for finance, St Kitts and Nevis (chairman)

- Dr Ellis Lorenzo Webster, premier and minister for finance, Anguilla

- Gaston Browne, prime minister and minister for finance, Antigua and Barbuda

- Roosevelt Skerrit, prime minister and minister for finance, the Commonwealth of Dominica

- Dr Keith Mitchell, prime minister and minister for finance, Grenada

- Easton Taylor-Farrell, premier and minister for finance, Montserrat

- Allen Chastanet, prime minister and minister for finance, Saint Lucia

- Camillo Gonsalves, minister for finance, Saint Vincent and the Grenadines