By Caribbean News Global ![]()

CASTRIES, St Lucia (CNG Business) – Prime minister and minister for finance, Philip J. Pierre, tabled a resolution in parliament, Tuesday, July 11, 2023, to provide additional economic relief to the public and spur economic development by the removal of Value Added Tax (VAT) on select building materials, says the Office of the Prime Minister, Tuesday, July 11, 2023.

Prime minister Pierre’s 12.5 percent VAT amnesty on select building materials is set to take effect on August 2, 2023.

St Lucia’s 2023/24 budget: Re-positioning mid-term for general elections

“The prime minister first informed the parliament and the Saint Lucian public of the government’s intention to remove VAT on building materials during his budget address in April,” explains the OPM.

However, the policy roll-out was not realized, similar to the 2.5 percent levy moved from July 1 to August 2, 2023.

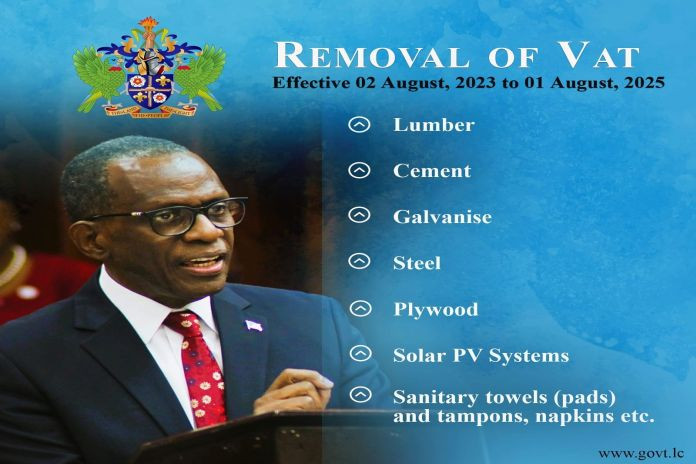

On July 11, 2023, the lower house by affirmation, expressed support for the prime minister’s resolution to suspend VAT charges, a reduction of 12.5 percent on plywood, lumber, cement, steel, galvanise and solar PV systems from August 2, 2023, to August 1, 2025.

“In my 2023/24 budget address, I announced that we would remove the VAT for 2 years on certain items. [Today] I am happy to put forward this amendment in the House of Assembly to remove the 12.5 percent VAT on lumber, cement, steel, plywood, galvanise, Solar PV systems and female sanitary products. Therefore, the retail price of these items will be reduced by 12.5 percent from 2 August, 2023. These policies will encourage growth and benefit the people of this country.” #PhilipCares

Caribbean News Global (CNG) previously stated in the article St Lucia’s 2023/24 budget: Re-positioning mid-term for general elections:

“The 2023/24 incentives of No VAT on building materials from July 2023 for two years – general elections due 2026 – are notably not concentrated in development and/or production sectors and [currently] not specified to scale up benchmarks and economic goals, [subject to change]. However, the same ole metamorphous that there is potential to stimulate growth in the local economy while also creating employment, is the common twaddle, presented as economic substance.

“In the ethos of “putting people first” VAT or no VAT, requires money and ‘money supply’. If salaries remain stagnant and money stock remains affected, by inflation, goods and services are likely to remain unchanged. And thus, without people and commerce, there is no economy.”

The OPM press release continued:

“Saint Lucia’s housing market to benefit from prime minister Pierre’s two-year VAT amnesty on selected building materials.”

The landscape proves indifferent retorts an economist:

“The VAT amnesty on these selected items are possible cost reduction to those who are currently engaged in the construction of homes, infrastructure, etc. Also, these ‘VAT’ reductions are not sufficient incentives to increase construction. Other factors will determine that, inclusive of the availability of income and income levels. The Kenny Anthony administration attempted that between 2011-16 and reported $45 million in losses.”

First …

“Dr Kenny Anthony explained as published, Thursday, August 23, 2012: “The government of Saint Lucia is forgoing over EC$45 million in revenue to execute the construction stimulus which will bolster the economy and empower citizens to build.”

Second …

“In the ethos of “putting people first” VAT or no VAT, requires money and ‘money supply’. If salaries remain stagnant and money stock remains affected, by inflation, goods and services are likely to remain unchanged. And thus, without people and commerce, there is no economy.”

In the apparent effort to define the two-year amnesty, the OPM continued:

“Home remodelling and renovation projects will be more affordable for the average Saint Lucian. Contractors will also benefit from the reduced cost of building materials for medium to larger projects. The social and economic realities of ordinary Saint Lucians continue to inspire the people-first policies of the Pierre administration. This latest tax relief measure will increase consumer spending power and, boost the construction industry through job creation and projects.”

Insight

The public will always welcome any reduction in VAT. The confusion is in the less-than-smooth roll-out and the logistics associated with exempt status on selected items.

The government of Saint Lucia has been untidy in its messaging, narrative and communication of same.