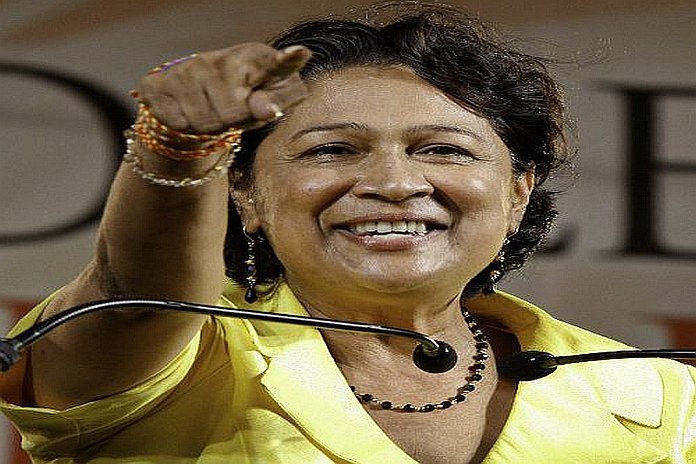

By Kamla Persad-Bissessar, SC, MP

This year is critical, as you know, as we are closer to the 2020 general election. And in preparation, we have continued our screening process for candidates, and let me tell you, we are so impressed with not just the quantity of nominees who have put themselves forward, but the quality of these persons.

We’ve received more than 350 nominations for seats across the country, from people from all walks of life. This is encouraging. It shows that people are ready to move with us. They believe in our vision and they have accepted our plan to move our country forward.

A few weeks ago, we presented two candidates to contest the general elections, and from the feedback, we’ve been getting, they have both been well received, and are making strides in their respective constituencies.

Senator Taharqa Obika for Point Fortin is an Economist, Banker, and lecturer by Profession. He has emerged from service to the people and is committed to the development of all the citizens of Trinidad and Tobago. He is an alumni of Presentation College San Fernando and UWI St Augustine and proud son of Point Fortin. Taharqa holds a B.Sc. in Economics, from UWI St Augustine and an MBA in Finance from the Ghana Institute of Management and Public Administration. He currently serves in the Senate as an opposition Senator, where he holds the government accountable.

Taharqa has also served as a lecturer at the Trinidad and Tobago Hospitality and Tourism Institute, Head of Operations – Central Finance Facility Cooperative Society Limited, and Senior Credit Analyst – Corporate Banking, Republic Bank Limited. Taharqa is also a writer and storyteller.

Michelle Benjamin for Moruga/Tableland is the current local government representative for Hindustan / St Mary’s, serving her second term as Councillor.

She was raised and educated in this community, having attended the Cowen Hamilton Secondary and Southern Community College. She went on to obtain a Diploma in Computer Studies from the School of Accounting and Management, and a Bachelor of Science Degree in Environmental and Natural Resource Management and Biology from the University of the West Indies.

She is family-oriented and an active member of the Baptist Community. Michelle is affiliated with a number of non-government organizations and youth groups. She has been involved with the United National Congress (UNC) for a number of years and has served as chairwoman of the Moruga/Tableland constituency executive since 2017.

After graduating from University, she immediately started working to improve the lives of others, supporting residents through difficult periods and contributing to local events. As a Councillor, she is passionate about providing a better future for her local community. Michelle has added value to the quality of life of the burgesses and improved her community.

Vibrant, educated and motivated, Michelle plans to work to implement positive changes that will rejuvenate the lives of the people in her community. Benjamin intends to represent every segment of the electoral district with accountability, integrity, fairness and without fear or favour.

Performance is key to her and she intends to make strides in the journey of the development of her beloved hometown. Thank you both. You have risen to the challenge, and we know that you will be successful.

Remember – serve the people, serve the people, serve the people. This is what the UNC is about – working to improve the lives of all citizens, not a select few. And again, to those who were not selected, do not lose heart – you have an important role to play in the campaign. We need all hands on deck in our effort to return good governance to Trinidad and Tobago.

Threats to democracy

My friends, I don’t need to remind you about the critical importance of the 2020 general election. We must remain vigilant. You would have seen what is going on in other countries, most recently in our neighbour – Guyana.

It is very worrying about what is happening there, with the election results being called into question. We note the concerns raised by CARICOM and international observers about irregularities and the concern about possible electoral fraud raised by the United States.

We hope for a resolution soon, and that the will of the people of Guyana is upheld. We are very concerned about what is taking place in Guyana and given that our general election is due this year, we call for international observers to be present for that poll. You will recall what happened in 2015 – a matter which we challenged in court.

International observers should be present for the 2020 general election to ensure that the process is monitored. Our election must be free and fair, and free from fear. We are asking for the electoral process to be monitored to ensure that it is transparent and credible. The future of our country and our people are at stake.

Economy in crisis

[Tonight] I want to raise a serious issue. This government has presided over the collapse of our economy. Instead of finding creative ways in which to create revenue, their only plan is to tax and borrow. Today, the public sector debt under this Dr Keith Rowley government stands at $122 billion (CBTT Economic Bulletin p. 24), the highest ever in our nation’s history.

They accused us of borrowing but tonight I want to say we didn’t borrow for friends, financiers, Faris and Foster, we borrowed so that we could spend to develop Trinidad and Tobago, we borrowed to create jobs and to ensure the safety of our citizens.

We invested in infrastructure development – on roads, bridges, hospitals, as well as national security, social services and people. They accused us of maxing out the overdraft, but you know what they did, they increased the overdraft ceiling, meaning they can borrow more money and Imbert super-maxed that overdraft.

When contractors are not getting paid or they are not hiring it is because they are using public monies to finance interest payments on the overdraft account.

Borrowings

A few months after Colm Imbert was sworn in as the minister of finance, he ran to the parliament to increase government borrowing by $50 billion as follows:

An increase in the statutory borrowing limit under the Development Loans Act, Chap. 71:04 from $30 billion to $45 billion; an increase in the statutory borrowing limit under the External Loans Act, Chap. 71:05, from $15 billion to $30 billion; and an increase in the statutory borrowing limit under the Guarantee of Loans (Companies) Act, Chap. 71:82, from $25 billion to $45 billion.

So they continue to engage in wild borrowings. Right before the election, they are coming to the Parliament to pass a law to borrow more money, they are coming to borrow an additional $10 billion under the Development Loans Act, Chap. 71:04.

After the borrowed all of that money and spent it out, we are faced with the second-highest murder toll in our nation’s history, the highest level of unemployment, the worst roads, cutting of social services- food cards and baby grants, closed schools and a failing health care system.

Borrowing

I want to explore two sets of borrowing in particular – this has to deal with a company called NCB Global Finance Limited. Do you know about that company?

The chief executive officer of that company is a person by the name of Angus Young- the brother of the all-purpose minister- Stuart Young.

NCB Global Finance is a financial institution and amongst other things, they are involved in the business of loans. Just like any other commercial bank, they make profits by lending customers money and they charge an interest rate on the sum that is loaned.

Interestingly enough, NCB Global Finance has been the premier choice of banking by this Rowley government. In July 2016, the NCB Global Finance was selected as the bank of choice by the NFM which advanced a US$10 million loan.

On December 08, 2016, the National Insurance Board of Trinidad and Tobago invested US $35 million in Guardian Holdings Limited. The arranger and lender for that transaction was who? NCB Global Finance.

From September 2015 to present- NCB Global Finance had forex transactions with Trinidad Nitrogen Company Limited in the total sum of $14.7 million US dollars.

In April 2019, the Trinidad and Tobago Tourism Business Development Company added NCB Global Finance as an approved financial institution for loans to hotels under 50 rooms and tourism-related businesses in Tobago.

On November 15, 2018, the same day that the prime minister assigned UDECOTT to be under the control of the office of the prime minister, UDECOTT entered into a loan with NCB Global Finance in the sum of TT$180.3 million. So, NCB loaned UDECOTT TT$180.3 million and will now be making profits from the interest payment of this loan.

On June 15, 2019, NCB Global Finance loaned Petrotrin US$16.127 million to repay a Republic Bank for a loan Petrotrin had taken from Republic Bank.

In summary, the government would have borrowed approximately TT$357 million from NCB Global Finance. We are unaware of what would be the interest rates and fees on those loans, so, therefore, we don’t know the profits that NCB Global Finance will make on those transactions.

I now have in my possession two Cabinet minutes where two more loans were approved by the Cabinet to NCB Global Finance.

$400M – National Maintenance and Security Company Ltd – Cabinet Minute 1 attached

The first loan is in the sum of $400 Million to the National Maintenance and Security Company Limited. On October 9, 2019, the matter was considered by the Cabinet and on the same day, the Cabinet approved the loan.

Matters that involve such great amounts of money, the Cabinet will usually take some time to consider the matter and then come back a week or more later to approve the note that was brought.

In this case, a matter considered on October 9, 2019, and approved on October 9, 2019. Cabinet approved that MTS acquire the loan from NCB Global Finance in the sum of $400 Million at an interest rate of 4.45 percent for nine years.

According to Appendix 1, of the Cabinet Note, NCB Global Finance will be receiving from the government the grand total of $164.6 million in interest profit from that loan.

They competed with other established commercial banks such as ANSA Merchant Bank Limited, First Citizens Bank, Republic Bank, RBC and Scotiabank.

US$25 million fixed-rate loan to Petrotrin – Cabinet Minute 2 attached

On October 31, 2019, Cabinet again on the same day it considered the matter agreed to acquire the loan in the sum of US$25 million which was to refinance a previous loan Petrotrin had with First Citizens Bank.

This loan the interest rate is 3.25 percent for two years, so by a rough calculation, the profits that NCB Global Finance will make is approximately TT$11 million after two years on this loan. So imagine right here in Point a Pierre, when they shut down the refinery, lie to the population, that they will make Heritage Petroleum profitable, here they are borrowing US$25 Million to refinance debt.

They have caused you to lose your jobs, leave your families hungry while the selected few profit from the shutdown of the refinery. NCB Global Finance is going to profit millions of dollars in interest payment from that US$25 million loan.

You know who was the other bank which tendered for the loan? First Caribbean International Bank. They weren’t successful. But on the May 02, 2019, First Caribbean International Bank, was the collateral agent for NCB Global Finance when they received a loan in the sum of $US25 million.

This means NCB Global Finance won the bid against First Caribbean which is the same Bank that is lending them money. There was another loan I spoke of earlier that NCB Global Finance financed for Petrotrin on June 15, 2019, where Petrotrin had to repay Republic Bank US$16.127 million.

We warned the government that when they shut down the refinery there will be a further shortage of forex, you know in a letter dated 01st October 2019, written by Petrotrin what it said, “It should be noted that as a consequence of Petrotrin’s cessation of operations, the absence of a GORTT guarantee and the unavailability of $US, the NCB loan had to be cased secured with TT$ at a gross margin of 11 percent (i.e. US$18.87 million equivalent).

That simply means that there is no US, so Petrotrin had to now borrow almost US$2 million additional to cover the loan with Republic Bank.

According to documents registered in the Companies Registry and as I stated earlier, 02nd May 2019, NCB Global Finance borrowed US $25 million and First Caribbean stood as security for that loan.

NCB Global Finance also borrowed US$50 Million from First Citizens Trustee Services Limited. So, they are borrowing. So in total NCB Global Finance has lent the government TT$357 million as stated earlier now adding the MTS loan and the Petrotrin loan, they would have loaned to the government TT$927 Million.

The total interest payments on the MTS loan and the Petrotrin loan will be approximately TT$175.6 million. But, I have some questions which I would like to ask, I cast no aspersions of wrongdoing, I am simply asking the following:

How does NCB Global Finance, which borrows money from First Caribbean International Bank and First Citizens, able to offer lower interest rates after it borrowed monies from these same banks?

Is it a coincidence that NCB Global Finance was able to offer the lowest interest rate in all these transactions outbidding well established financial institutions such as First Citizens Bank, Republic Bank, Scotiabank, Royal Bank, and Ansa Merchant Bank?

According to NCB Global financial statement for 2019, their asset base is TT$383 million. How is it that a company with such a small asset base is able to loan the government close to TT$1 billion?

NCB Global Finance has one of the smallest balance sheet of all the well-established financial players in Trinidad and Tobago, yet it was able to offer all those financing arrangements on a fully underwritten basis meaning that NCB Global Finance guarantees that government would receive the full sum of the funding in one disbursement.

In the MTS Loan, NCB Global Finance submitted its bid very late, which was five days before the note was presented to the Cabinet. Can the Minister of Finance indicate the date in which the invitation to bid went out and the dates on which the other banks submitted their bids?

Did NCB Global Finance submit its bid last? Did Stuart Young disclose to the Cabinet that his brother is the chief executive officer of NCB Global Finance?

Did Stuart Young recuse himself from the Cabinet meeting when all matters relating to the award of a mandate to NCB Global Finance limited was being deliberated?

Did Stuart recuse himself from the Cabinet when the decision was made that the company which his brother is the chief executive officer of will profit approximately TT$175.6 Million in interest payments from the MTS and Petrotrin loans?

While they give their supporters 500 a week these people are making hundreds of million. Peoples National Movement (PNM) supporters need to wake up.

Everything my government gave to you and your children this government took away, watch who getting it now while you all suffering the families of the johnny come lately’s raking it in. You have been betrayed by your own party leadership.

The readiness of Couva Children’s Hospital

We have heard from the minister of health that the Couva Hospital would have been open since July of last year, it has been almost five years and they cannot open it.

They have hired no new staff, doctors, nurses or technicians, but they will be hurry to run down to Couva to cut a ribbon that they opened the Hospital. We left that Hospital fully equipped and we had a plan to open it.

They have decided to allow the Couva Hospital to hold 150 patients.

This is an internal Memo from head of department outlining the issues to Transfer to the Couva Hospital:

What about the kitchen?

The plan is to prepare all the meals at the Mt hope Hospital and shuttle it down three times a day for the patients. You ever hear nonsense. There is a fully equipped kitchen at the Couva Hospital- while there may be no small equipment, they left the large equipment non-operational causing the warranty to elapse, out of spite and wickedness.

So, the manager is a former army man- Capt. (Ret’d) Dexter A Horsford and we have a memo from him dated February 19, 2020. Someone will benefit from the purchasing of vehicles or being given the contract to transport the food from Mt Hope to Couva. It shows that they have no plan and that they are not ready to truly open the Couva Hospital.

I have today caused a claim to be filed in the Supreme court against minister Deyalsingh for damages for defamation CV 2020 -00940.

UNC’s plan to move Trinidad and Tobago forward

My friends, as I have noted, we are in dire straits due to the lack of competent strategy, political will and most of all innovation by the current PNM administration. But, there is hope. The UNC’s National Economic Transformation Master Plan was created with the purpose of putting people back to work.

The future of our nation and the success of our upcoming generations depends on all of us adopting a new, “business unusual” spirit, breaking away from old outmoded approaches. We invite everyone to visit www.uncplan2020.com to learn more about the UNC’s vision for Trinidad and Tobago.

The UNC’s philosophy has always been to listen and then lead, and we engaged in a series of consultations with key stakeholders, experts and citizens in developing our plan. We welcome all comments and suggestions from all citizens, as this is the only way we can progress as one people and one nation.

I believe in our people. We have the potential to return our nation to prosperity and a path of sustainable growth and development. I love my country. Do you love your country? Then join us. Let us save our country. Let us put this country back to work.