By Miguel Angel, Carpio,Lorena Keller, and Alessandro Tomarchio

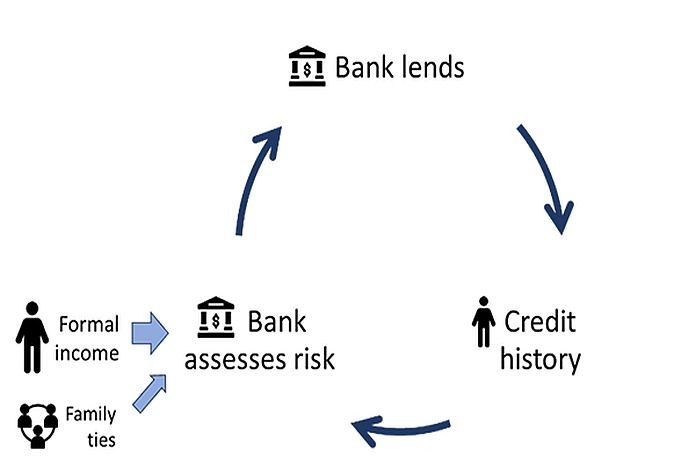

Getting a bank loan for the first time enables an individual to enter a virtuous lending circle. This loan allows obtaining credit reports, which will be used by the bank and its competitors to analyze new credit requirements from then onward (figure 1). How do individuals get in this loop? Banks usually make their lending decisions based on official documents on income, such as pay stubs and receipts of sales. In developing economies, however, this presents a problem. The majority of the people work in the informal sector and therefore do not have this information to provide to banks. Do all banks give up trying to attract new customers under these conditions?

Figure 1: The virtuous lending circle

In a recent paper (Carpio, Keller, and Tomarchio 2022), we use a large-scale data set that contains the universe of loans in five regions in the southern highlands of Peru to show that an important group of banks could be using family ties to bring new customers into the lending circle. We start by showing that first time borrowers are more likely to receive credit from the bank where their family is more connected . We also find that more family connections imply better loan terms, such as lower interest rates and greater loan amounts.

Method and data

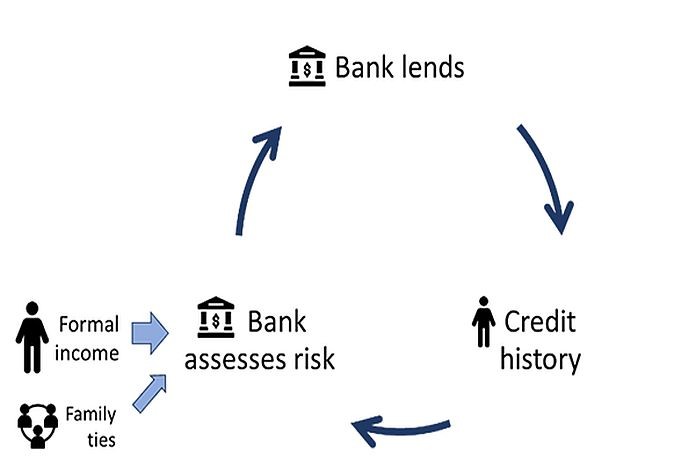

How do we measure family connections in a banking system? We leverage naming conventions in Peru to build family networks for every first time borrower in each of their available banks. Figure 2 illustrates our procedure. First, we define family as every district-surname combination. Second, we define a tie as the joint occurrence of the paternal and maternal surnames in an individual’s name. Take, for example, an individual named Diego Ancco Puclla. This name indicates a tie between the nodes Ancco and Puclla in the figure.

Third, we use these definitions and the clients’ portfolio of banks to draw family networks as depicted by figure 2. Better connected families are located at the center. Finally, we compute each family’s network centrality, a measure of the number of connections and the connectedness of these connections. This indicator, taken from the network literature, determines the size of every node in our illustration.

Figure 2: Illustration of a family network

We use detailed data from the Peruvian credit registry from 2010 to 2019. To estimate the effect of network centrality on the probability of receiving a loan, we cannot simply compare individuals with different family connections. A different probability of accessing credit between two individuals could be explained by family networks, but also by different personal or family characteristics. Similarly, we cannot compare only different banks, districts, or times. Otherwise, a different probability of accessing a loan could be explained by particular bank and district characteristics, as well as economic events occurring at a particular time.

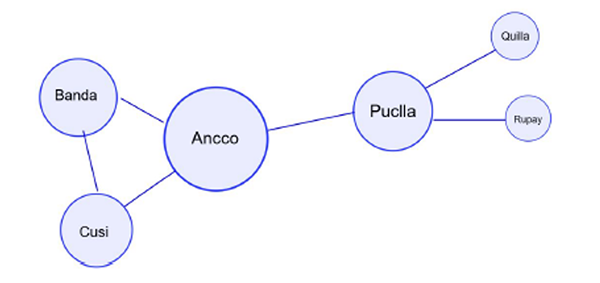

Hence, we simultaneously compare (i) the probability of the same first time borrower getting a loan across banks where the borrower’s family has different connections, and (ii) whether the same bank, in the same district and same time, gives a loan to an individual whose family is more connected relative to one who is less connected within the portfolio of banks. We illustrate our methodology in figure 3. A first time borrower whose surname is “1” has a larger centrality in bank A (0.16) than in bank B (0.07); hence, we predict that borrower “1” will obtain credit from bank A. At the same time, within bank A, the individual with surname “1” has higher probability of getting a loan compared with the individual with surname “3,” but less so compared with the individual with surname “8.”

Figure 3: Illustration of family networks in bank portfolios

Results and mechanisms

Importantly, our results are driven exclusively by the group of banks that target informal workers, known as cajas. Unlike traditional banks, these informal oriented banks are a large group of small and risky banks that operate in a highly competitive environment. What actions do these banks take to generate the effect of centrality on the probability of receiving credit? We find evidence that informal oriented banks use family ties as a strategy to reach the unbanked. They bring the unbanked into the virtuous lending loop through two channels: (i) the perk mechanism and (ii) the reputation transfer mechanism.

First, the perk mechanism consists of banks providing credit to first time borrowers who are family members of clients, to retain the latter. Informal oriented banks operate in a competitive environment and may want to prevent their clients from migrating to other banks, by granting a first loan to a client’s relative . To explore this mechanism, we exploit that several individuals have open loans in more than one bank. Our evidence suggests that they stay longer in the bank that provides a first loan to a family member. The probability of having a positive balance is larger in this bank and it happens only once the credit is issued.

Second, the reputation transfer mechanism consists of banks inferring the first time borrowers’ ability to pay from their relatives’ reputation. Without official documents on income, informal oriented banks could proxy the creditworthiness of a prospective client by assuming that it resembles their family’s . We find that “family reputation” ends up being a good predictor of the future behavior of an individual who receives credit for the first time.

In sum, we find evidence that informal oriented banks exploit family networks to bring individuals with more connected families into the virtuous lending circle. We believe that our research opens new questions. For instance, do banks in other regions, including developed countries, also use family networks to substitute the lack of hard information on those who are engaged in informal activities? If not, could they use family networks in the future? The fact that banks with characteristics similar to those we label here informal oriented banks partially serve both the informal sector and minorities suggests that this may indeed be the case.

![]()