By Caribbean News Global contributor

ROSEAU, Dominica – Prime Minister Roosevelt Skerrit delivering his budget address for the 2020/2021 fiscal year referenced Dominica, was the fastest growing economy in Latin America and Caribbean region in 2019. And, despite the odds of COVID-19, the country is already showing signs of economic recovery.

The following are extracts from the 2020/2021 budget:

Every few years our country has been adversely impacted by exogenous shocks, which have led to life altering changes. I reference in particular, two major weather events in 2015 and 2017, which resulted in combined losses of more than 310 percent of GDP, and now in 2020, the dreaded COVID-19 pandemic. But this government is not daunted by these crisis situations, as with God on our side, we are confident that we will overcome them.

At the end of 2019, this country elected a new government. A strong mandate was given to the Dominica Labour Party and to me, as your prime minister. Determined to “build back better,” we developed the nationally embraced vision of a new Dynamic Dominica, coupled with our National Resilience Development Strategy.

I take the opportunity [today] on this occasion of the first budget after elections, to again thank the citizens of this country, for reposing confidence in this government.

When we woke up on January 1 to the new year 2020, it was with hope, excitement, and confidence that our collective, and national fortunes were turning the corner. We had rebounded from Hurricane Maria and put in place new building blocks on which our future growth and development would rest.

In January 2020, we gained more encouragement from the assessment and forecast of the International Monetary Fund (IMF), that the Dominica economy was set to expand by, 5.5, 4.5 and 3.6 percent, for the years 2020, 2021 and 2022 respectively. It must not escape our attention that the growth projection of 5.5 percent for Dominica, was 2.1 percentage points higher than the economic growth rate which the IMF was also projecting, for the countries in the Eastern Caribbean Currency Union (ECCU). By any measure, Dominica was doing extremely well.

Today, over 16 million people in the world have contracted the coronavirus SARS COV2, or COVID-19, from which over 650,000 have died. This government has had to divert significant resources to bolster the health sector and ensure an effective national response to the COVID-19 pandemic. According to the John Hopkins University, Coronavirus Resource Center, Dominica has the third lowest incidence of the disease of 185 countries in the world, with only 18 cases and no deaths.

Prior to COVID-19, the IMF reported that global growth had been 2.9 percent in 2019 and was expected to be 2.3 in 2020. By June of this year however, when presenting a global economic update in the World Economic Outlook (WEO), the IMF described the COVID-19 pandemic and its impacts, as a “crisis like no other.”

According to the WEO, “the baseline forecast, envisions a 5.2 percent contraction in global GDP in 2020. Growth in the group of emerging market and developing economies is forecast at minus 3.0 percent in 2020. Growth among low-income developing countries is projected at minus 1.0 percent in 2020.

The IMF reports that for the first time, all regions are projected to experience negative growth in 2020. The small island developing states of the Caribbean, are standing on the precipice of the greatest risk to our economies and societies, in modern history, with an expected contraction of eight percent. This is a disturbing forecast.

Macroeconomic performance and outlook

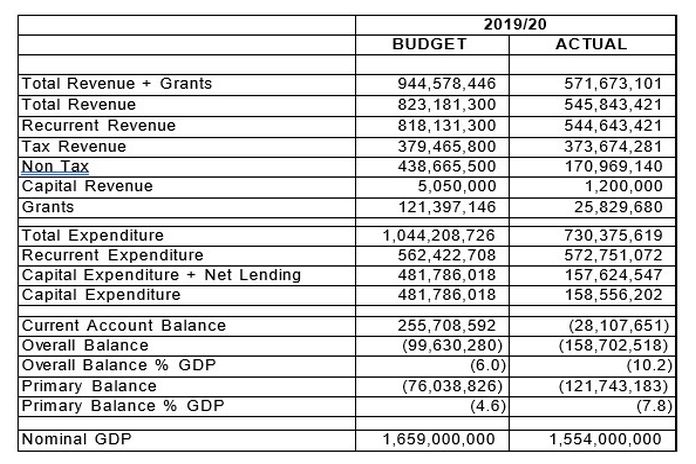

At the beginning of the last fiscal year, that is July 2019, we had forecasted an overall fiscal deficit of 6.0 percent, and a primary deficit of 4.6 percent of GDP, by June 2020. However due to strong tax revenue performance, along with close management of expenditure, during the first six months of that fiscal year, the IMF in January 2020, projected that the overall deficit would fall to 1.2 percent of GDP, and there would be a small primary surplus of 0.6 percent of GDP, by the end of June 2020. The broad fiscal target is a surplus of 2.4 percent of GDP.

By contrast, preliminary data now shows an overall deficit of 10.2 percent of GDP, and a primary deficit of 7.8 percent of GDP for fiscal year 2019/20. This fiscal outcome is primarily as a result of a COVID-19 induced, revenue shortfall of some 33.6 percent and a sharp increase in unplanned expenditure associated with the containment of the virus.

Table 1 below shows a comparison between the budget and projected out-turn for fiscal year 2019/20.

Notwithstanding what has transpired over the last six months, this government is still optimistic of a recovery of the economy. Barring further disasters, the outlook suggests a 3.5 percent expansion in economic activity in 2021, as the impact of the pandemic dissipates, and the economy returns to normal. Growth is expected to average 2.3 percent over the medium term.

Overview of public debt

At the end of fiscal year June 30, 2020, the government’s external debt stood at $683.5 million, of which $599.8 million is central government debt, and $83.7 million is debt guaranteed for public corporations.

Domestic debt for the same period amounted to $550.4 million, of which $481 million is held by central government, and $69.2 million is guaranteed by central government for public corporations.

During the fiscal year 2019/20, a sum of $52.8 million was borrowed from external sources, to manage the spread of the COVID-19 disease and mitigate against its adverse impact on the economy. An amount of $37.9 million came from the IMF under the Rapid Credit Facility, $6.7 million from the Caribbean Development Bank (CDB), and $8.2 million, was borrowed from the World Bank’s, International Development Association (IDA), as part of the OECS Regional Health Project. The resolutions to authorize these facilities, will be presented at the next sitting of parliament.

On the domestic side, government converted a portion of its overdraft balance, and non- performing loans of the Public Works Corporation, to a 20-year loan in the sum of $125.0 million.

The total debt to GDP as at June 30, 2020, is estimated at 79.4 percent, with central government debt to GDP at 69.6 percent.

Building financial resilience

A Disaster Resilience Strategy (DRS) was recently developed with technical assistance from the IMF. It is government’s intention to include that Strategy as an Annex to the Climate Resilience and Recovery Plan (CRRP), which was published in May 2020. The DRS is built on three pillars:

- Pillar I: Structural resilience

- Pillar II: Financial resilience

- Pillar III: Post-disaster resilience

To achieve financial resilience, more robust and up to date public finance management legislation is required. With the support of the Caribbean Regional Technical Assistance Centre (CARTAC), a new Public Finance Management Bill has been drafted, and is being reviewed.

Budgetary proposals for 2020/21

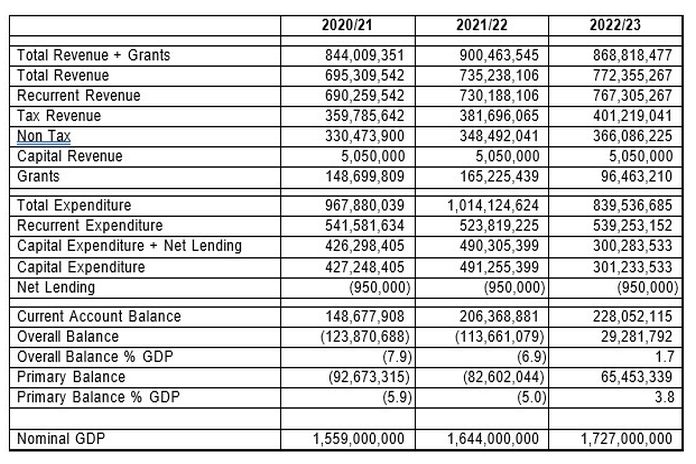

The budgetary and fiscal position point to an overall deficit of 7.9 percent of GDP, and a primary deficit of 5.9 percent of GDP. Using conservative estimates, it assumes marginal increases over the Fiscal Year 2019/20 in some of the major components of tax revenue, and a return to normal CBI revenue activity. Estimates for capital revenue are in keeping with expected receipts from the sale of government assets. The Budget also assumes the utilisation of committed grants to finance a large part of the capital programme.

Table 2 summarizes the 2020/21 budget, along with the forecast for the next two years. This framework projects further fiscal deficits for 2021/22, and a return to overall and primary surpluses by the third year.

Recurrent revenue

As already indicated, there were weaker than expected revenue collections, during the third and fourth quarters of fiscal year 2019/20, as a result of the COVID-19 pandemic. Preliminary data indicates total revenue fell short of projections by 33.4 percent.

Table 3 [reference page 40 pdf] gives a summary of the estimates of recurrent revenue for 2020/21. Total revenue $ 695.3.

The major contributors are: Value Added Tax – $145.6 (20.9%) -International Trade Taxes – $88.4 (12.7%) -Other Domestic Taxes – $66.1 (9.5%) – Non-Tax Revenue – $330.5 (47.5%)- Personal Income Tax – $31.6 (4.5%) – Corporate Income Tax – $24.5 (3.5%).

Recurrent expenditure

In fiscal year 2020/21 the total recurrent expenditure, inclusive of interest and debt amortization, is $606.5 million.

Specific line ministry allocations

The largest allocation of the budget is under the ministry of finance in the sum of $245.7 million. This includes an amount of $31.2 million for interest payments, and an amount of $59.9 million, representing debt amortization and the contribution to the Sinking Fund. The sum of $36.5 million is comprised of retiring benefits to public officers, along with the payment of compassionate allowances and non-contributory pensions, to senior citizens over the age of seventy.

The ministry of education, human resource planning, vocational training, and national excellence, will receive the second highest allocation of $74.4 million.

The ministry of health, wellness and new health investment has been allocated $59.9 million, or 9.9 percent of the total recurrent budget.

The ministry of national security and home affairs will receive an allocation of $53.2 million or 8.8 percent.

The ministry of public works and the digital economy is allocated $52.3 million, or 8.7 percent of the recurrent expenditure. A significant portion is allocated towards funding the newly installed telecommunications network, to facilitate our digital transformation.

The ministry of foreign affairs, international business and diaspora relations has been allocated $20.5 million, or 4.4 percent.

The ministry of tourism, international transport and maritime initiatives has been allocated $17.5 million or 2.9 percent of the total, $13.0 million of this amount is allocated to marketing and improving access to Dominica.

The public sector investment programme for fiscal year 2020/21 is estimated at $427.2 million and is financed as follows: Local funds: 235.7 million – Loan: 47.0 million – Grants: 144.5 million.

“As we go forward, as a united nation, and in this period of uncertainty, we appreciate now more than ever, that our strongest currency is faith. We have once again shown to the world, our resilience; and together we will meet the next challenge with the same vigour as before. History has repeatedly taught us that, the Dominican spirit always rises. Our development agenda remains on track – and we are well on our way to delivering the promise of a Dynamic Dominica,” said prime minister Skerrit.

[…] allocated to the government’s public sector investment programme, strengthening the theme “Dynamic Dominica – Building on the Past, Solidifying our Present and Securing the […]